54+ what percentage of gross income should go to mortgage

Whats an ideal mortgage-to-income ratio. What percentage of income should mortgage be.

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Ad Compare the Best House Loans for February 2023.

. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. 36 DTI or lower.

Even with this 43 threshold lenders generally require a more. Web Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Web Cadence Bank What Percentage of Income Should Go to Mortgage.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Get Instantly Matched With Your Ideal Mortgage Lender. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

So if your gross. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web Keep your mortgage payment at 28 of your gross monthly income or lower Keep your total monthly debts including your mortgage payment at 36 of your. Ad Highest Satisfaction for Mortgage Origination. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Compare More Than Just Rates. Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers.

Web How Much Of My Income Should I Be Using To Pay Off Debt. Apply Get Pre-Approved Today. Web Most lenders agree that if you have debt such as credit card bills or a car payment no more than 28 percent of your monthly gross income should go toward.

Find A Lender That Offers Great Service. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance. Apply Online To Enjoy A Service.

Lock Your Rate Today. On a 400000 property a 20. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Heres how lenders typically view DTI. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage. The 3545 Rule The 3545.

Web This model states that your.

What Percentage Of Your Income Should Go To Mortgage Chase

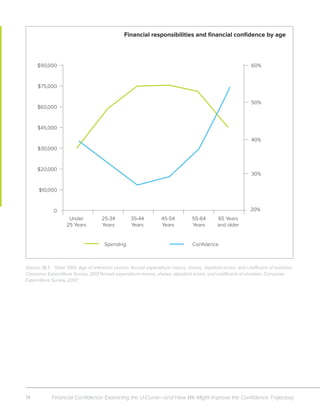

Learn Vest Financial Confidence Curve

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Mortgage Statement 10 Examples Format Pdf Examples

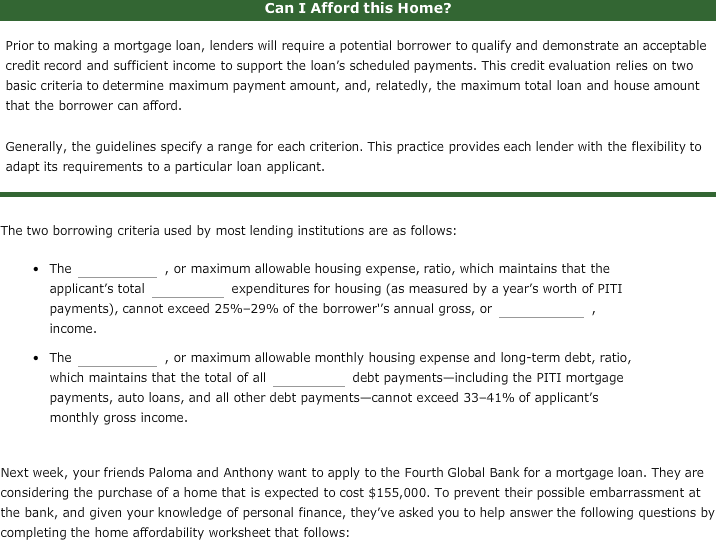

Solved First Filling The Blank A Back End B Front End Chegg Com

Annual Report 2021

Learn Vest Financial Confidence Curve

Learn Vest Financial Confidence Curve

How Much Of My Income Should Go Towards A Mortgage Payment

Business Succession Planning And Exit Strategies For The Closely Held

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Income Should Go To A Mortgage Bankrate

G136892kk15pi004 Gif

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Module 2 Lessons 4 To 6 Pdf Mortgage Loan Homelessness